Top Emerging Business Opportunities in Asia and Europe: A Comparative Analysis

Exploring the dynamic landscapes of Asia and Europe reveals a plethora of emerging business opportunities waiting to be tapped. From innovative startups to established enterprises, this article delves into the key factors driving growth and success in these regions, providing a comprehensive overview for aspiring entrepreneurs and investors alike.

Asia

Asia presents a multitude of emerging business opportunities driven by various factors such as technological advancements, growing middle-class population, and favorable government policies. The business landscape in different Asian countries varies, offering diverse investment prospects for entrepreneurs and investors alike.

Technology Sector

The technology sector in Asia is booming, with countries like China, India, and South Korea leading the way in innovation and digital transformation. Tech giants such as Alibaba, Tencent, and Samsung have made a significant impact on the economy, driving growth and creating employment opportunities.

E-commerce Industry

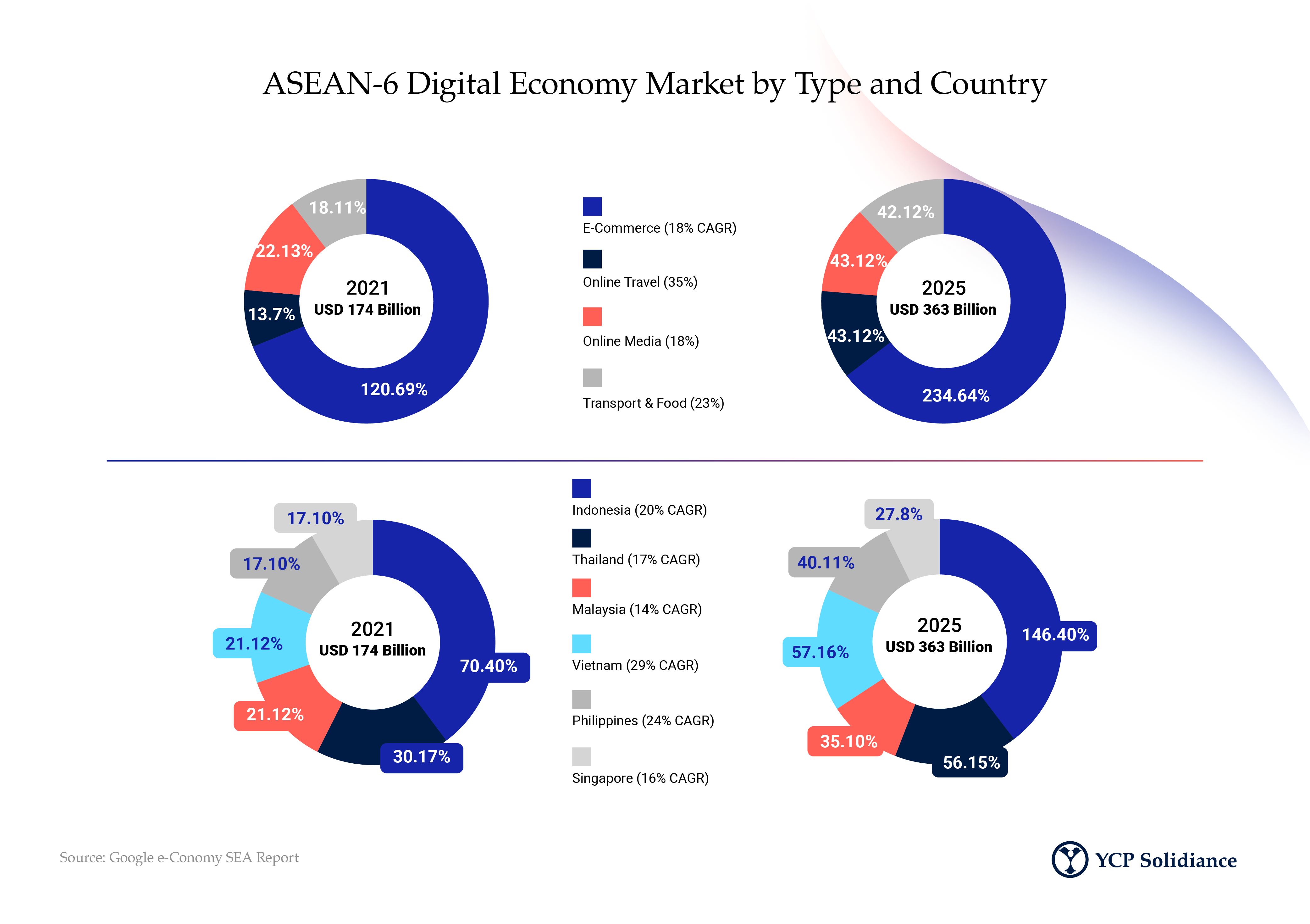

The e-commerce industry in Asia is experiencing rapid growth, fueled by increasing internet penetration and changing consumer preferences. Companies like Alibaba, JD.com, and Flipkart have revolutionized the way people shop, leading to a surge in online retail sales across the region.

Renewable Energy Sector

Asia has been investing heavily in renewable energy sources such as solar and wind power to meet the growing energy demands sustainably. Countries like China and India are leading the way in renewable energy production, attracting investments from both domestic and international players.

Healthcare and Biotech Sector

The healthcare and biotech sector in Asia is witnessing significant growth, driven by an aging population and increasing healthcare spending. Companies like Takeda Pharmaceutical and Sinopharm Group are at the forefront of medical innovation, contributing to the overall development of the healthcare industry in the region.

Europe

Europe presents a diverse landscape for emerging business opportunities, with various sectors showing significant growth potential. The regulatory environment, startup culture, and technological adaptation also play crucial roles in shaping the business landscape in different European countries.

Emerging Business Sectors in Europe

- Renewable Energy: With a strong focus on sustainability, renewable energy sources such as wind and solar power are gaining traction in Europe.

- Healthcare Technology: The healthcare sector in Europe is embracing technological advancements to improve patient care and efficiency.

- E-commerce: The e-commerce market in Europe is rapidly expanding, offering opportunities for businesses to reach a wider customer base.

- Fintech: Financial technology is a growing sector in Europe, with innovations in payment systems, lending, and digital banking.

Regulatory Environment for New Businesses in Europe

The regulatory environment for new businesses in Europe varies from country to country, with each having its own set of rules and regulations. However, the European Union provides a unified framework for certain aspects of business operations, promoting cross-border trade and investment.

Startup Culture in Different European Countries

- United Kingdom: The UK has a vibrant startup ecosystem, with London being a hub for tech startups and innovative business ventures.

- Germany: Known for its strong industrial base, Germany offers a supportive environment for startups in manufacturing, automotive, and engineering sectors.

- Sweden: Sweden is renowned for its entrepreneurial spirit, with a focus on sustainability and innovation in sectors such as tech and healthcare.

- France: France has a growing startup culture, particularly in the tech and fashion industries, with government support for innovation and entrepreneurship.

Adaptation to Technological Advancements in European Businesses

European businesses are actively adapting to technological advancements to stay competitive in the global market. From implementing AI and machine learning to digitizing operations and embracing automation, businesses in Europe are leveraging technology to enhance efficiency and drive innovation.

Market Trends

In today’s global economy, market trends play a crucial role in shaping business opportunities in Asia and Europe. Understanding these trends is essential for businesses to stay competitive and adapt to the changing landscape.

Globalization Impact

Globalization has significantly impacted business opportunities in Asia and Europe by breaking down barriers to trade and investment. Companies can now reach a wider market and tap into new opportunities across borders. This has led to increased competition but also opened up new avenues for growth and expansion.

Consumer Behavior Trends

Consumer behavior trends are constantly evolving in both Asia and Europe, influencing business decisions in various industries. From the rise of e-commerce and digital payments to the growing demand for sustainable and ethical products, understanding these trends is crucial for businesses to meet consumer expectations and stay relevant in the market.

Sustainability and Green Initiatives

The focus on sustainability and green initiatives is gaining momentum in both Asia and Europe, presenting new business opportunities for companies that prioritize environmental and social responsibility. From renewable energy projects to eco-friendly products and services, businesses that align with sustainable practices are well-positioned to capitalize on this growing trend and meet the demands of conscious consumers.

Investment Opportunities

Investing in both Asia and Europe presents a myriad of opportunities for foreign investors looking to diversify their portfolios and tap into growing markets. While each region has its unique set of risks and rewards, understanding the potential for growth and scalability is crucial for making informed investment decisions.

Comparison of Risks and Rewards

Investing in Asian markets often comes with higher volatility and regulatory challenges compared to European markets. However, the potential for high returns is also greater in rapidly developing economies like China and India. On the other hand, European markets offer stability and a well-established regulatory environment, but the returns may be more moderate.

Potential for Growth and Scalability

Both Asia and Europe have industries poised for significant growth, such as technology, healthcare, and renewable energy. With a large consumer base and increasing middle-class population, Asia presents opportunities for businesses to scale quickly. Meanwhile, Europe boasts innovation hubs and a skilled workforce, providing a solid foundation for sustainable growth.

Examples of Successful Cross-Border Investments

One notable example of successful cross-border investment is SoftBank’s Vision Fund, which has made strategic investments in tech companies across Asia and Europe. Another example is the acquisition of ARM Holdings by Japan’s SoftBank, showcasing the potential for collaboration between Asian and European companies for mutual growth.

Epilogue

In conclusion, the juxtaposition of business opportunities in Asia and Europe showcases the diversity and potential for growth in both regions. As the global market continues to evolve, staying informed and adaptable is key to capitalizing on these emerging trends and opportunities.

Question & Answer Hub

What are some key factors driving business growth in Asia?

Factors such as rapid urbanization, technological advancements, and a growing middle class contribute to the vibrant business landscape in Asia.

How do European businesses adapt to technological advancements?

European businesses often leverage technology to enhance efficiency, improve customer experience, and stay competitive in the global market.

What are some examples of successful cross-border investments in Asia and Europe?

Notable examples include joint ventures between Asian and European companies, strategic acquisitions, and collaborative research projects.